3 Key Takeaways:

- Understand the 10 essential EPF contribution rules to ensure full legal compliance and avoid costly penalties.

- Learn how EPF contribution affects employee trust, payroll accuracy, and company credibility.

- Discover how HR outsourcing with experts like MUSTRE helps SMEs streamline contributions and stay aligned with the Employment Act 1955.

Understanding your obligations under the Malaysia EPF contribution scheme is crucial for every employer aiming to operate a compliant and trustworthy business.

As an integral part of employee benefits in Malaysia, the Employees Provident Fund (EPF) ensures long-term financial security for the workforce—and non-compliance isn’t just risky, it’s costly.

Hire us!

Elevate your business with tailored HR solutions, including compliance, talent acquisition, culture building, and streamlined processes. Unlock success today!

For Small and Medium Enterprises (SMEs) and startups, navigating the complexities of EPF rules can feel overwhelming—especially without a dedicated in-house HR department.

The rules surrounding contribution rates, deadlines, payroll inclusions, foreign workers, and voluntary top-ups are layered with legal requirements under the Employment Act 1955 and enforced by KWSP (Kumpulan Wang Simpanan Pekerja).

Even a minor miscalculation or missed deadline could trigger penalties, erode employee trust, and invite regulatory audits.

Whether you’re registering your company for EPF for the first time, adjusting contributions for different age brackets, or ensuring payroll items are accurately included or excluded, understanding the 10 key EPF rules is essential.

Moreover, with digital tools and HR outsourcing services like MUSTRE, compliance doesn’t have to be a burden.

This blog post breaks down everything every Malaysian employer needs to know—from legal contribution percentages to monthly remittance deadlines, what counts as “contributable wages,” and how to handle special cases like expatriate employees and voluntary contributions.

We’ll also highlight common mistakes businesses make and how to avoid them—using real-world testimonials from employers who have successfully managed their HR with MUSTRE’s help.

If you’re ready to gain clarity, stay compliant, and protect your business and your employees—read on.

These 10 rules could make or break your HR compliance.

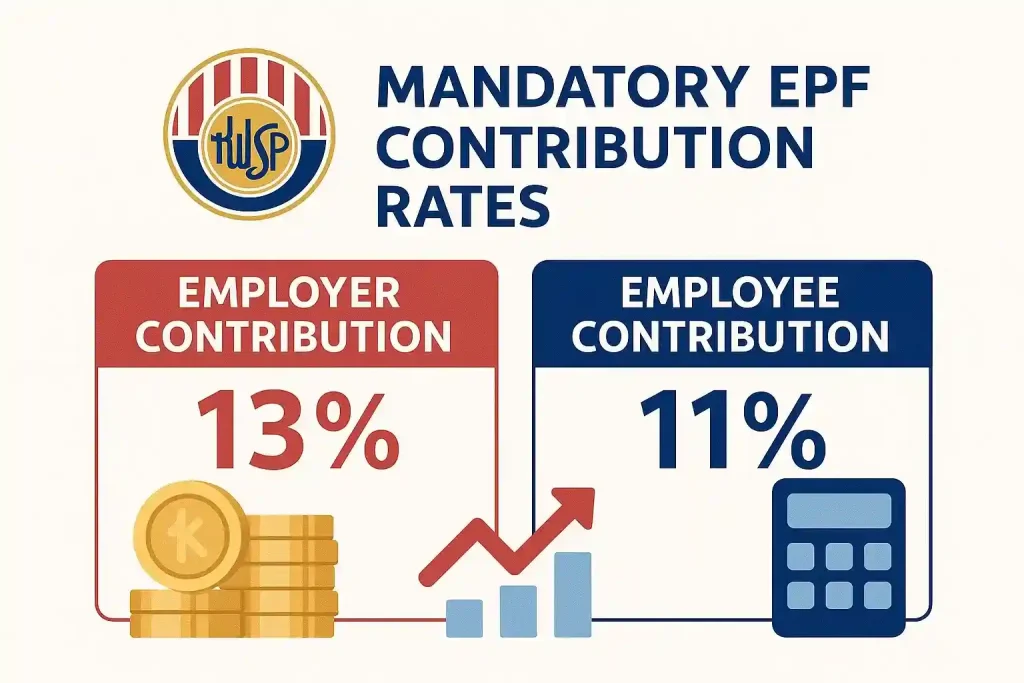

1. What Is the Mandatory EPF Contribution Rate Employers Must Follow

As of 2024, employers must contribute 13% of the employee’s monthly wages if the employee earns RM5,000 or less. This employer epf contribution is mandatory and cannot be negotiated. For those earning above RM5,000, the contribution is 12%.

Employees themselves must contribute 11% of their wages.

These contributions apply to citizens and permanent residents. E

mployers are not allowed to negotiate lower rates outside what’s legally mandated.

“We have been collaborating for more than 2 years... MTR Solutions have demonstrated a high level of professionalism...”

DrNaz

2. Why EPF Registration Is Your First Legal Obligation

Registering your company and employees with KWSP must be done immediately upon hiring.

It’s one of the first steps toward legal employment and a requirement under the EPF Act 1991.

“Clear, fast, and professional communication… makes it very easy for us to manage salaries, holidays, etc.”

Nurul Atiqah Shamsudin

3. When Must You Remit EPF Contributions Each Month

Employers must pay EPF contributions on or before the 15th of every month.

Delays can incur penalties, including fines and dividend charges on overdue amounts.

“Excellent service… no more HR hassles.”

Hui Ting Tan

4. How to Calculate Contributions Based on Salary, Age & Foreign Status

Check the epf contribution table 2025 regularly for any updates.

For example:

- A 30-year-old earning RM3,000 would have RM390 contributed by the employer and RM330 by the employee.

- Foreign workers are typically not required to contribute unless they are permanent residents.

“Thank God, MTR helps me manage my staff in a more organized manner…”

Anna Rosdijanti

5. What Payments Are Included—or Excluded—in EPF Calculations

Included:

- Basic salary

- Overtime pay

- Commissions

- Allowances

- Bonuses

Excluded:

- Reimbursements

- Retirement gratuities

- Travel allowances

“Alhamdulillah, recommended HR team to manage staff based on employment law.”

Fatin Athifah Official

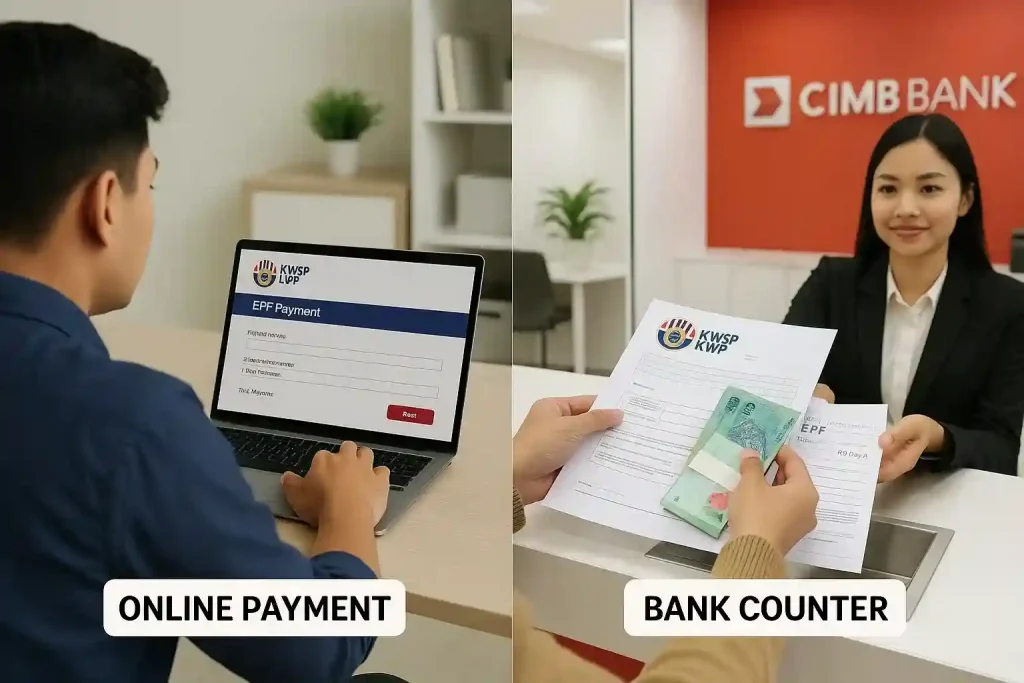

6. Where and How to Pay: Online vs Bank Counter Options

You can pay EPF via:

- KWSP i-Akaun (Employer)

- FPX (online banking)

- EPF counters (for special cases)

Most businesses automate this using payroll software or outsourcing firms like MUSTRE.

“Trusted & Recommended for those who wish to outsource their Payroll & HR matter!”

Nor Sabrina

7. Can Employers Deduct EPF Contributions from Employees?

Yes. The employee’s portion (11%) is deducted from their gross monthly wages before payment.

However, this must be clearly itemized in the payslip and done correctly every cycle.

“Very helpful. Thank you!”

Firdaus Ishak

8. What Are the Penalties If Contributions Are Late or Missing?

Late EPF payments will incur:

- A dividend rate on overdue amounts

- Fines up to RM10,000 or imprisonment upon prosecution

Audit action may be taken, and backdated contributions must still be paid.

“MTR handles it professionally and calmly... Recommended!” – Tengku Azrul Engku Chik

Tengku Azrul Engku Chik

9. How to Maintain Accurate Records and Reconcile Contributions

Employers must:

- Keep monthly payroll reports

- Track each employee’s contribution record

- Reconcile payments against KWSP receipts

Digital solutions or outsourcing can help avoid administrative errors.

“Finally able to complete the latest employee handbook based on the 2024 act...”

Dahlia Naz

10. Do These Special Cases Apply? Voluntary, Excess & Reduced Contributions

Employers and employees may opt for:

- Voluntary contributions (higher than minimum)

- Reduced contributions during government-approved periods

- Third-party contributions (e.g., Tabung Haji)

“To every new business owner, let MTR save your time and money.”

Iwaninav

Common Challenges in Malaysia EPF Company Contribution

What Are the Biggest Obstacles?

- Confusing contribution rates by age

- Forgetting remittance deadlines

- Unclear breakdown of salary components

How to Overcome These Challenges

- Automate payroll systems

- Set monthly reminders

- Outsource to expert HR firms like MUSTRE

Best Practices for Malaysia EPF Contribution Compliance

Actionable Tips for Success

- Cross-check contribution tables regularly

- Train HR/payroll staff thoroughly

- Ensure payslips show proper breakdowns

Tools & Resources to Help You

- KWSP i-Akaun Employer

- MUSTRE HR & Payroll Services

- Payroll software (SQL, Kakitangan, HReasily)

Strengthen Your Business with These EPF Practices

Mastering the Malaysia EPF contribution rules isn’t just about legal compliance—it’s about building trust, protecting your business, and empowering your workforce.

Whether you’re managing a small team or scaling a growing company, these 10 essential rules serve as the foundation for a smooth and secure HR process.

Stay informed, stay compliant, and let expertise lead the way.

Managing EPF contributions and HR compliance doesn’t have to be overwhelming.

At MUSTRE, we offer tailored HR outsourcing, payroll services, and compliance support designed specifically for Malaysian businesses like yours.

✅ Whatsapp now for a free consultation today and discover how we can streamline your HR and payroll operations while keeping you aligned with the latest labor laws.

Frequently Asked Questions (FAQ)

1. What is the current Malaysia EPF contribution rate for employers and employees?

As of 2024, employers must contribute 13% of the employee’s monthly wages if the salary is RM5,000 or below, and 12% if above RM5,000.

Employees must contribute 11%, regardless of income level.

These rates apply to Malaysian citizens and permanent residents only.

2. How do I make a Malaysia EPF contribution online?

How do I make a Malaysia EPF contribution online? Employers asking about malaysia epf contribution online should use the KWSP i-Akaun (Employer) portal; payments can be made via FPX or integrated payroll software.

3. What happens if I miss the Malaysia EPF contribution deadline?

Missing the 15th-day monthly deadline may result in late payment charges, dividends on unpaid amounts, and legal penalties, including fines or prosecution.

It’s crucial to schedule regular reminders or outsource payroll to ensure compliance.

4. What are the top responsibilities of employers regarding EPF contributions?

Understanding the epf employer contribution is the first step to avoiding penalties and building employee trust. Employers must ensure all contributions are correctly calculated, remitted on time, and clearly reflected in payslips. Automated payroll systems or outsourcing to HR experts like MUSTRE can help maintain accurate epf employer contribution records.

5. Are bonuses and allowances part of the Malaysia EPF contribution calculation?

Yes. Payments like bonuses, overtime, commissions, and fixed allowances are included when calculating Malaysia EPF contributions.

Exclusions include reimbursements, travel allowances, and retirement gratuities.